Master Your Finances: A Guide to a Realistic Debt Repayment Budget

Creating a realistic debt repayment budget is key to achieving financial freedom by providing a structured plan to pay off debts efficiently while managing income and expenses effectively.

Are you tired of being weighed down by debt? Learning how to create a realistic debt repayment budget: a practical guide for financial freedom is the first step towards regaining control of your finances. Let’s dive in and map out your path to financial liberation.

Understanding Your Current Financial Situation

Before diving into a budget, it’s crucial to understand your current financial situation. This means assessing your income, expenses, and debts to get a clear picture of where your money is going.

Assessing Your Income

Start by calculating your total monthly income. This includes your salary, any side hustle income, and other sources of revenue you receive regularly.

Tracking Your Expenses

Next, track your expenses. Use budgeting apps, spreadsheets, or old-fashioned pen and paper to monitor where your money is going each month. Categorize these expenses to understand where you can potentially cut back.

Once you have a list of all income sources and expense categories, it’s time to calculate the overall financial health.

- List all income: Include salary, investments, and other regular streams.

- Categorize expenses: Group spending into necessities and discretionary items.

- Identify leaks: Locate areas where you can reduce spending without sacrifice.

By assessing your current finances, you get a solid base to find out how to achieve a debt-free future.

Calculating Your Total Debt

The next important step is calculating your total debt. It’s necessary to know the amount you owe in order to properly devise your budget.

Listing All Debts

Compile a list of all your debts, including credit card balances, student loans, car loans, mortgages, and any other outstanding obligations. For each debt, note the interest rate and minimum monthly payment.

Prioritizing Debts

Once you have a list of debts, prioritize them based on interest rates. Consider using debt payoff strategies like the debt avalanche or debt snowball method.

It helps to know how to manage your debt based on what kind of debt you have.

- High-interest debt first: Focus on debts with the highest interest rates.

- Debt avalanche: Pay extra on smallest debt while making min payments on all debts.

- Debt snowball: Pay extra on debt with highest interest rate while making min payments on all debts.

Calculate the total debt by listing all debts, then organize based on interest rates so you can find out which debts to tackle first in your budget.

Setting Realistic Financial Goals

Setting realistic financial goals is crucial for staying motivated and focused on your debt repayment journey. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Defining SMART Goals

Start by defining your SMART goals. For example, aim to pay off a specific credit card balance within a certain timeframe. Break down larger goals into smaller, manageable steps.

Adjusting Goals Over Time

As you make progress, adjust your goals to stay on track. Celebrate milestones and acknowledge your achievements along the way to maintain momentum and stay motivated.

By setting SMART goals, it is easier to be motivated to pay off any debt that you have, even the large amounts.

- Specific targets: Identify exactly what you plan to achieve with your budget.

- Track your progress: Monitor your financial status using online tools and apps.

- Celebrate success: Acknowledge milestones with small rewards to stay inspired.

Ultimately, setting realistic financial goals is all about making sure you achieve them.

Creating Your Debt Repayment Budget

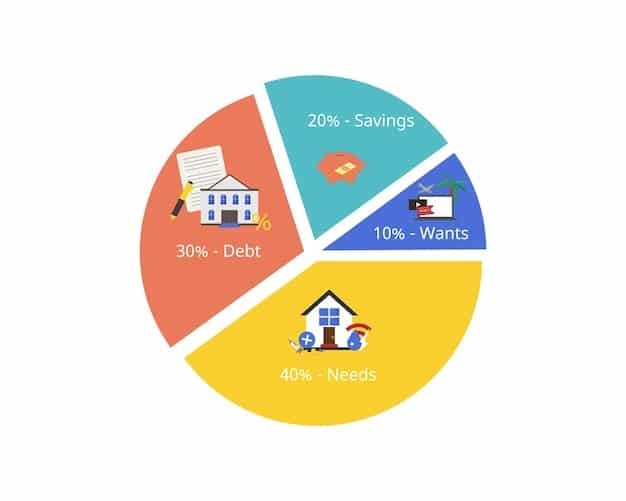

Creating your debt repayment budget involves allocating funds from your income to cover essential expenses and debt payments. Aim to allocate as much as possible towards debt repayment while maintaining a balanced financial plan.

Allocating Funds

First, allocate funds for essential expenses such as housing, food, utilities, and transportation. Then, determine how much you can realistically allocate to debt repayment each month.

Prioritizing Expenses

Prioritize your financial goals, focusing on the most pressing items.

Creating a budget is more than just numbers; it helps you establish a healthy financial plan.

- Fixed vs. variable expenses: Know which expenses are inflexible versus adjustable.

- Emergency funds: Set aside a buffer while still making debt payments.

- Negotiate lower rates: Talk to creditors about lower interest rates on your debt.

Creating your debt repayment budget is a way for you to find financial security by allocating your funds.

Tools and Resources for Budgeting

Effective budgeting can be greatly enhanced by leveraging various tools and resources designed to streamline processes and provide valuable insights.

Budgeting Apps

Start by harnessing the power of budgeting apps such as Mint, YNAB (You Need A Budget), or Personal Capital. These apps can help you track your spending.

Financial Counseling Services

Consider seeking guidance from nonprofit credit counseling agencies like the National Foundation for Credit Counseling. These organization provide free or low-cost financial advice.

Utilizing the right tools and resources is all part of making sure you have a solid financial plan that is sure to succeed.

- Spreadsheet templates: Leverage pre-built templates from Google Sheets or Microsoft Excel.

- Online calculators: Utilize resources for assessing loan repayment and savings goals.

- Books & websites: Increase your financial knowledge across diverse channels.

From apps to financial counseling services, using the right tools will benefit you going forward.

Monitoring and Adjusting Your Budget

Consistently monitoring and adjusting your budget is essential to ensure it remains effective and aligned with your financial goals. Life evolves, and your budget should too.

Regular Check-ins

Schedule regular check-ins, such as monthly or quarterly, to review your budget and track your progress, making adjustments to spending.

Adapting to Changes

Be prepared to adapt to changes in income, expenses, or financial goals. Stay flexible.

Monitoring and adjusting can help you make sure you stay on track with paying your debt.

- Review regularly: Ensure there’s time set aside each month to assess your finances.

- Track key metrics: Monitor income, expense, and debt levels to make sure balances are correct.

- Stay informed: Keep up with economic shifts that can alter your plans.

Be sure to adjust when you need to so you can get to a place where you are debt free.

| Key Aspect | Brief Description |

|---|---|

| 📊 Assess Income | Calculate total monthly income from all sources. |

| 📝 Track Expenses | Monitor and categorize all monthly spending. |

| 🎯 Set SMART Goals | Define specific, measurable, achievable, relevant, and time-bound goals. |

| 🛠️ Use Budgeting Tools | Employ apps or spreadsheets for efficient budget management. |

Frequently Asked Questions

▼

A debt repayment budget is a financial plan that outlines how you will allocate your income to pay off outstanding debts, while still covering essential living expenses.

▼

Calculate your total debt by listing all outstanding balances from credit cards, loans, and other obligations, then summing them up to find the overall amount you owe.

▼

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. They provide a clear framework that makes it easier to accomplish significant financial milestones.

▼

Tools that can help with budgeting include budgeting apps, spreadsheets, and financial counseling services. Also utilize loan repayment calculators and financial literacy websites.

▼

You should review your budget regularly, ideally monthly or quarterly, to assess your progress. Make adjustments as required based on changes in your financial circumstances.

Conclusion

By following these steps, you can learn how to create a realistic debt repayment budget: a practical guide for financial freedom. Remember, consistency and discipline are key to achieving your financial goals and securing a debt-free future.