Long-Term Care Costs: Plan for $9,000 Monthly Expense in 2025

Long-Term care costs are rising, with the national average expected to reach $9,000 per month in 2025; planning involves understanding these costs, exploring insurance options, and leveraging financial strategies to ensure long-term security.

Are you prepared for the escalating costs of long-term care? With the average monthly expense projected to reach $9,000 in 2025, understanding and planning for long-term care costs: how to plan for the average $9,000 monthly expense in 2025 is more critical than ever for your financial well-being.

Understanding Long-Term Care Costs in 2025

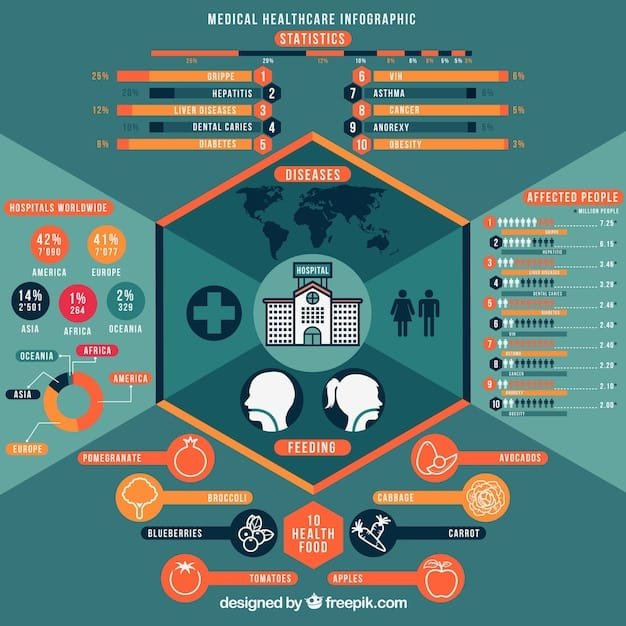

Long-term care encompasses a range of services designed to meet the health or personal care needs of individuals who are unable to perform daily activities on their own. As the population ages, the demand for these services is increasing, driving up costs. It’s crucial to understand these costs to make informed financial decisions.

Several factors contribute to the rising expense of long-term care, including inflation, increased demand, and the growing complexity of medical treatments. Understanding these trends can help you better prepare for future expenses.

Key Drivers of Long-Term Care Costs

- Inflation: The cost of goods and services generally increases over time, and healthcare is no exception.

- Increased Demand: As the population ages, more people require long-term care services, driving up demand and prices.

- Advanced Medical Treatments: Modern healthcare offers more advanced treatments, but these often come with higher price tags.

Projecting future costs is essential for effective planning. While $9,000 per month is an average, actual costs can vary based on location, type of care, and individual needs. Researching local costs and understanding your specific needs are vital steps.

Exploring Long-Term Care Insurance

Long-term care insurance is designed to cover the costs associated with these services, providing financial protection when you need it most. Understanding what these policies cover and how they work is essential.

Long-term care insurance policies typically cover a range of services, including nursing home care, assisted living, and in-home care. Some policies also cover adult day care and care coordination services.

Key Features of Long-Term Care Insurance

- Daily Benefit Amount: The maximum amount the policy will pay per day for covered services.

- Benefit Period: The length of time the policy will pay benefits (e.g., 2 years, 5 years, lifetime).

- Elimination Period: The period you must pay for services out-of-pocket before the policy starts paying benefits.

When evaluating long-term care insurance, consider factors such as your age, health status, and financial situation. Shop around and compare policies from multiple insurers to find the best fit for your needs. Work with a qualified financial advisor to assess your options and make informed decisions.

Alternative Financial Strategies for Long-Term Care

Besides insurance, there are various financial strategies you can use to prepare for long-term care expenses. These strategies involve leveraging different assets and savings to create a financial safety net.

One popular strategy is to earmark specific savings accounts for future care needs. Consider setting up a dedicated account or fund to grow over time, ensuring funds are available when needed.

Other Strategies to Consider

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, consider using an HSA to save for future medical expenses, including long-term care.

- Annuities: Certain annuities can provide a stream of income to help cover long-term care costs.

- Life Insurance with Long-Term Care Riders: Some life insurance policies include riders that allow you to access a portion of the death benefit to pay for long-term care.

Consulting a financial advisor can provide personalized guidance on creating a comprehensive financial plan that addresses long-term care needs, integrating insurance and other financial strategies effectively.

Leveraging Government Programs and Benefits

Government programs such as Medicare and Medicaid can provide assistance with long-term care costs, but eligibility requirements and coverage limitations apply. Understanding these programs is crucial for maximizing available benefits.

Medicare generally does not cover long-term custodial care but may cover some skilled nursing or rehabilitation services following a hospital stay. Understanding its limitations is essential for realistic planning.

Understanding Medicare and Medicaid

Medicaid provides more comprehensive coverage for long-term care services but has strict eligibility requirements based on income and assets. Planning and possibly restructuring assets may be necessary to qualify.

State-specific programs also offer assistance, so research what’s available in your area. Eligibility requirements vary, so understanding them is important for accessing these resources. Consulting with an elder law attorney or benefits specialist can provide guidance on navigating these programs and ensuring you receive the support you need.

The Role of Family and Caregiving

Family members often play a crucial role in providing long-term care, reducing the need for expensive institutional care. However, this can place a significant burden on caregivers, both emotionally and financially.

Having open and honest conversations about caregiving responsibilities is essential for setting realistic expectations and preventing burnout. Discussing the physical, emotional, and financial commitments involved is crucial.

Supporting Family Caregivers

Explore respite care services to give family caregivers a break. Consider family meetings to discuss long-term care needs and divide responsibilities. Caregiver support groups also offer valuable emotional support and resources.

Seeking professional assistance, such as hiring a home health aide or care manager, can supplement family caregiving efforts. These professionals can provide specialized care and guidance, reducing the burden on family members.

Planning Early and Staying Informed

The key to successfully managing long-term care costs: how to plan for the average $9,000 monthly expense in 2025 is to start planning early and stay informed about available resources and strategies. Regular reviews and adjustments to your plan are essential.

The earlier you start planning, the more options you’ll have and the more time you’ll have to accumulate resources. Early planning allows you to take advantage of insurance options and financial strategies that may not be available later in life.

Regular Reviews and Updates

Review your plan annually and adjust it as needed based on changes in your health, financial situation, and available resources. Stay informed about changes in long-term care costs, insurance options, and government programs.

Continuous learning and adaptation are essential for maintaining a comprehensive and effective long-term care plan. Consider joining organizations that provide information and resources, attending seminars, and working with qualified professionals who can guide you through the process.

| Key Point | Brief Description |

|---|---|

| 💰 Rising Costs | Long-term care expenses are expected to average $9,000 monthly in 2025. |

| 🛡️ LTC Insurance | Explore long-term care insurance to cover potential expenses. |

| 💸 Financial Planning | Consider strategies like HSAs and annuities to fund care. |

| 👨👩👧👦 Family Support | Discuss caregiving roles and seek family support to alleviate burdens. |

What are the key factors driving up long-term care costs?

▼

Options include long-term care insurance, personal savings, annuities, and government programs like Medicare and Medicaid. Each option has different eligibility requirements and coverage limitations.

▼

Long-term care insurance helps cover costs associated with services such as nursing home care, assisted living, and in-home care. Policies have daily benefit amounts, benefit periods, and elimination periods.

▼

Medicare generally doesn’t cover long-term custodial care but may cover some skilled nursing. Medicaid provides more comprehensive coverage but has strict income and asset eligibility requirements.

▼

Families should have open conversations about caregiving roles and seek respite care services. They can participate in support groups and, if necessary, seek professional assistance such as hiring a home health aide.

▼

Early planning allows for more options and time to accumulate resources. It also provides the opportunity to take advantage of insurance and financial strategies that may not be available later in life.

Conclusion

Preparing for long-term care costs, especially with projections reaching $9,000 per month by 2025, requires a multifaceted approach. By understanding the drivers behind these costs, exploring insurance options, leveraging financial strategies, and staying informed, you can develop a comprehensive plan to secure your financial future and ensure access to the care you need.