Inflation 2025: How 3.2% Impacts Your Financial Plan

Understanding how the projected 3.2% inflation rate in 2025 will impact your long-term financial plan involves reassessing your investment strategy, adjusting savings goals, and accounting for increased costs of goods and services, ultimately requiring proactive measures to mitigate risks and preserve purchasing power.

Navigating the future requires a clear understanding of economic forces, and the projected 3.2% inflation rate in 2025 is a crucial factor to consider when planning your financial future. This rate will touch various aspects of your financial life, from investments to savings. Let’s explore how to proactively protect and optimize your strategy.

How Will the 2025 Inflation Rate Affect Your Investments?

The projected 3.2% inflation rate in 2025 can significantly influence your investment returns. Understanding how different asset classes react to inflation can help you make informed decisions and adjust your portfolio accordingly.

Impact on Stocks

Stocks are often considered an inflation hedge, but their performance during inflationary periods can vary. Companies with pricing power – the ability to raise prices without significantly impacting demand – tend to perform well. Other factors include the overall economic environment and sector-specific dynamics.

Impact on Bonds

Inflation erodes the real value of fixed-income investments like bonds. As inflation rises, the purchasing power of future interest payments decreases. Investors often demand higher yields on bonds to compensate for this risk, which can lead to lower bond prices.

- Consider Treasury Inflation-Protected Securities (TIPS), which are designed to protect investors from inflation. The principal of TIPS increases with inflation and decreases with deflation.

- Explore short-term bonds and bond funds, as they are less sensitive to interest rate changes caused by inflation.

- Diversify your bond portfolio to include a mix of maturities and credit qualities.

Real Estate and Commodities

Real estate and commodities are often viewed as inflation hedges. Real estate values tend to increase during inflationary periods as the cost of housing and rent rises. Commodities, such as gold and oil, can also hold their value or increase in price as inflation rises.

Consider diversifying into real estate investment trusts (REITs) or commodity-based exchange-traded funds (ETFs) to gain exposure to these asset classes without directly owning physical properties or commodities.

In conclusion, understanding how inflation impacts different asset classes is crucial for constructing a resilient investment portfolio. Diversifying your investments and considering inflation-protected securities can help mitigate the impact of inflation on your long-term financial goals.

How Inflation Influences Your Savings and Budgeting

The 3.2% inflation rate in 2025 will directly affect your savings and budgeting strategies. It’s essential to adjust your financial plans to account for the rising cost of goods and services to maintain your purchasing power and achieve your long-term financial objectives.

Impact on Everyday Expenses

Inflation increases the cost of everyday expenses, such as groceries, transportation, and healthcare. To maintain your current standard of living, you may need to allocate more of your budget to these essential items.

Adjusting Your Savings Goals

To account for inflation, you may need to increase your savings goals to ensure you have enough money to cover future expenses. Consider using inflation-adjusted savings calculators to determine how much you need to save to reach your financial milestones.

- Evaluate your current savings rate and identify areas where you can cut expenses to increase your savings.

- Consider automating your savings contributions to ensure you consistently save towards your goals.

- Review your insurance coverage to ensure you have adequate protection against unexpected events.

Explore high-yield savings accounts or certificates of deposit (CDs) to earn a better return on your savings. While these options may not outpace inflation entirely, they can help offset some of its effects.

By proactively adjusting your savings and budgeting strategies, you can mitigate the impact of inflation on your financial well-being. Regularly review your budget, track your expenses, and make necessary adjustments to stay on track towards your financial goals.

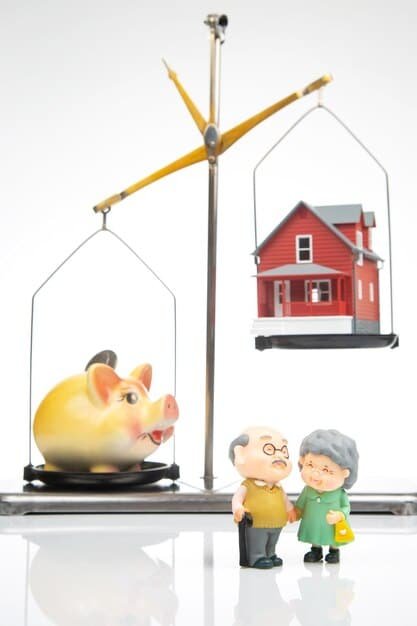

Inflation’s Effect on Retirement Planning

Retirement planning requires a long-term perspective, and the projected 3.2% inflation rate in 2025 can significantly impact your retirement savings. It’s crucial to factor in inflation when estimating your future expenses and determining how much you need to save for retirement.

Estimating Future Expenses

Inflation increases the cost of living over time, so it’s essential to estimate your future expenses in retirement while accounting for inflation. Consider using inflation-adjusted retirement calculators to project your expenses accurately.

Adjusting Your Retirement Savings

To ensure you have enough money to retire comfortably, you may need to increase your retirement savings to account for inflation. Maximize your contributions to employer-sponsored retirement plans, such as 401(k)s, and consider contributing to individual retirement accounts (IRAs).

- Consider delaying retirement by a few years to increase your savings and reduce the number of years you need to fund.

- Explore part-time work or consulting opportunities in retirement to supplement your income.

- Review your asset allocation to ensure it aligns with your risk tolerance and retirement goals.

Social Security Benefits

Social Security benefits are adjusted annually for inflation through the Cost-of-Living Adjustment (COLA). While this helps protect retirees from inflation, it may not fully offset the rising cost of living.

Consider strategies to optimize your Social Security benefits, such as delaying claiming benefits until age 70, which can result in a higher monthly payment.

Properly accounting for inflation in your retirement planning can help ensure you have enough money to enjoy a comfortable and financially secure retirement. Regularly review your retirement plan and make necessary adjustments to stay on track towards your goals.

Real Estate and Inflation: A Strategic Approach

Real estate can serve as a hedge against inflation, but its performance can vary depending on location, property type, and market conditions. It’s important to adopt a strategic approach when considering real estate as part of your long-term financial plan.

Owning Versus Renting

Owning a home can provide a hedge against inflation as mortgage payments typically remain fixed, while rents tend to increase with inflation. However, owning a home also comes with expenses, such as property taxes, insurance, and maintenance costs.

Investing in Rental Properties

Investing in rental properties can provide a stream of income that may increase with inflation as rents rise. However, managing rental properties requires time and effort, and there are risks associated with vacancy and property damage.

Consider diversifying your real estate investments by investing in REITs, which offer exposure to a variety of commercial and residential properties without the need for direct management.

Home Equity and Mortgages

Inflation erodes the real value of debt, which can benefit homeowners with fixed-rate mortgages. As inflation rises, the purchasing power of your mortgage debt decreases, making it easier to pay off over time.

However, borrowing against your home equity through a home equity loan or line of credit (HELOC) can be risky, as these loans often come with variable interest rates that can increase with inflation.

Adopting a strategic approach to real estate can help you leverage its potential as an inflation hedge while mitigating risks. Carefully evaluate your financial situation, risk tolerance, and investment goals before making any real estate decisions.

Managing Debt in an Inflationary Environment

Inflation can impact the real value of your debt, both positively and negatively. Managing your debt effectively is crucial in an inflationary environment to minimize risks and maximize financial opportunities.

Fixed vs. Variable Interest Rates

Fixed-rate debt, such as mortgages and fixed-rate loans, can be advantageous during inflationary periods as the interest rate remains constant, and the real value of the debt decreases over time. Variable-rate debt, such as credit card balances and variable-rate loans, can become more expensive as interest rates rise in response to inflation.

Prioritizing Debt Repayment

Prioritize paying off high-interest debt, such as credit card balances, to minimize interest charges and free up cash flow. Consider using debt repayment strategies, such as the debt avalanche or debt snowball method, to accelerate your debt repayment.

Explore options for consolidating high-interest debt into a lower-interest loan or balance transfer credit card to reduce interest charges and simplify your debt repayment.

The Impact on Business Loans

For businesses, inflation can impact the cost of borrowing and the expenses associated with operating the business. Carefully evaluate your financing options and manage your cash flow to navigate the challenges of an inflationary environment.

Managing debt effectively is an essential part of a sound financial plan. Evaluate your debt obligations, prioritize debt repayment, and explore options for refinancing or consolidating debt to reduce interest charges and improve your financial stability.

Adjusting Your Financial Plan for Long-Term Success

The projected 3.2% inflation rate in 2025 underscores the importance of regularly reviewing and adjusting your financial plan to ensure you stay on track towards your long-term goals. Proactive measures can help you mitigate risks and capitalize on opportunities in an inflationary environment.

Regular Financial Check-Ups

Schedule regular financial check-ups to assess your progress towards your goals and identify areas for improvement. Review your budget, savings, investments, and debt obligations to ensure they align with your financial objectives.

Rebalancing Your Portfolio

Rebalance your investment portfolio periodically to maintain your desired asset allocation. As some asset classes outperform others, your portfolio may become overweighted in certain areas. Rebalancing involves selling some assets and buying others to bring your portfolio back into alignment with your risk tolerance and investment goals.

Seeking Professional Advice

Consider seeking advice from a qualified financial advisor who can help you navigate the complexities of inflation and develop a personalized financial plan. A financial advisor can provide valuable insights and guidance to help you make informed decisions.

Staying informed about economic trends and adapting your financial plan accordingly can help you achieve long-term financial success. Proactive planning, regular reviews, and professional advice can empower you to navigate the challenges of inflation and pursue your financial goals with confidence.

| Key Point | Brief Description |

|---|---|

| 📈 Inflation’s Impact | Inflation affects investments, savings, and retirement planning. |

| 💰 Saving Strategies | Adjust savings goals, use high-yield accounts to offset inflation. |

| 🏡 Real Estate | Real estate can hedge inflation, but be strategic about owning vs. renting. |

| 📊 Debt Management | Prioritize repaying high-interest debt and manage variable rates. |

FAQ

▼

The projected inflation rate for 2025 is 3.2%. This means that, on average, the prices of goods and services are expected to increase by 3.2% over the year.

▼

Inflation erodes the purchasing power of your investment returns. It’s important to invest in assets that can outpace inflation, such as stocks, real estate, and commodities.

▼

Yes, you should review and adjust your budget to account for higher prices. This may involve reducing discretionary spending or finding ways to increase your income.

▼

Real estate values tend to increase during inflationary periods as the cost of housing and rent rises, making it a good hedge. Consider REITs for diversified exposure.

▼

Prioritize paying off high-interest debt and consider consolidating it into a lower-interest loan. Fixed-rate debt can be advantageous as the real value decreases.

Conclusion

Understanding the impact of the projected 3.2% inflation rate in 2025 on your long-term financial plan is crucial for maintaining financial stability and achieving your goals. By proactively adjusting your investment strategy, savings habits, and debt management practices, you can navigate the challenges of inflation and secure a prosperous financial future.